Florida Sales Tax Exempt Products

These products are exempt from sales taxes (no prescription needed)

Questions Leigh L Ceci Tax Law Specialist 850-717-6363

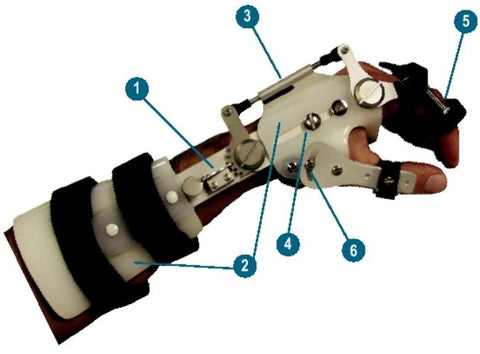

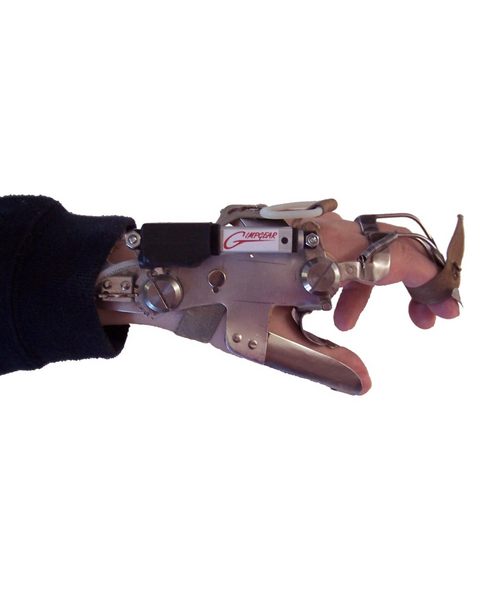

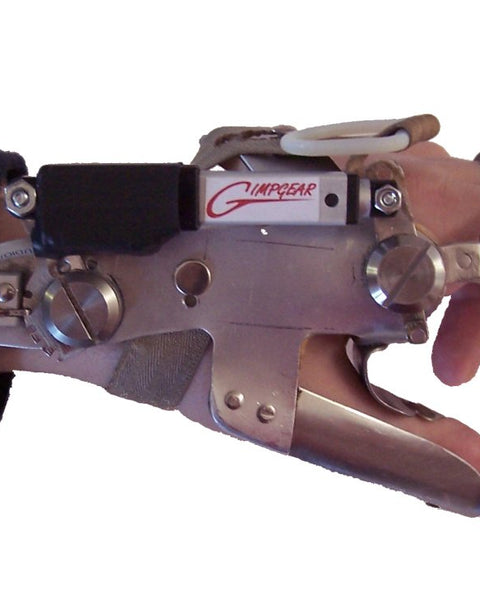

- Prosthetic and orthopedic appliances used to replace, substitute or alleviate the malfunction of any body part

- Ferticare / Viberect - alleviates paralysis of ejacalatory function

- Horizonal Bed - rolls patient replacing torso muscles

- Items for Independent Living when purchased for noncommercial home or personal use

- A bed transfer handle selling for $60 or less

- A bed rail selling for $110 or less

- A grab bar selling for $100 or less.

- A shower seat selling for $100 or less.

In addition, the following prosthetic and orthopedic appliances are specifically EXEMPT under Florida law Medical Items List DR-46NT or have been certified by the Department of Health as EXEMPT without a prescription.

- Abdominal belts

- Arch, foot, and heel supports; gels, insoles, and cushions, excluding shoe reliners and pads

- Artificial eyes

- Artificial limbs

- Artificial noses and ears

- Back braces

- Batteries, for use in prosthetic and orthopedic appliances

- Braces and supports worn on the body to correct or alleviate a physical incapacity or injury

- Canes (all)

- Crutches, crutch tips, and pads

- Dentures, denture repair kits, and cushions

- Dialysis machines and artificial kidney machines, parts, and accessories

- Fluidic breathing assistors; portable resuscitators

- Hearing aids (repair parts, batteries, wires, condensers)

- Heart stimulators and external defibrillators

- Mastectomy pads

- Ostomy pouch and accessories

- Patient safety vests

- Rupture belts

- Suspensories

- Trusses

- Urine collectors and accessories

- Walkers, including walker chairs

- Walking bars

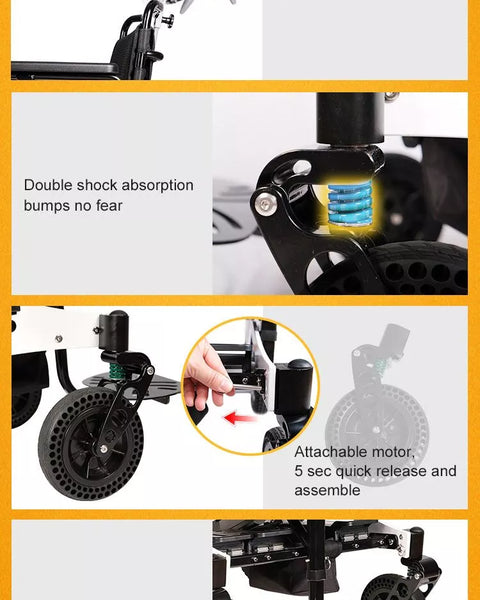

- New or used electrical or manual wheelchairs, motorized scooters. parts and repairs. Battery chargers or accessories like a cover are subject to sales tax.

- New walking aids (walking chairs, walking bars, crutches, and canes)

- New and used batteries specifically manufactured and labeled for electric wheelchairs and scooters

- New and used battery chargers specifically manufactured and adapted for electric wheelchairs and scooters

- New and used shrouds for wheelchairs and scooters

- New and used joysticks for electric wheelchairs and scooters

- Used wheelchair and scooter tires

- New and used leg rests for wheelchairs and scooters

- New and used replacement seats for wheelchairs and scooters

Require authorized prescription presented at time of sale to be exempt from sales tax in Florida

Prosthetic or orthopedic appliances dispensed according to an individual prescription written by a licensed practitioner (a physician, osteopathic physician, chiropractic physician, podiatric physician, or dentist duly licensed under Florida law) are EXEMPT

- Comfort Carrier?

- Patient Lifts?

- New bath bench (Adult Bath Bench-Premium-Drive Medical listed on Taxpayer’s website)

- New and used electric mobility lifts (for behind or in the vehicle)

- Electric wire harness for the electric mobility lifts

- New and used ramps (for use in vehicles and getting into the door of your house for wheelchairs). The ramps must be specifically designed and sold for use by individuals with wheelchairs and scooters.

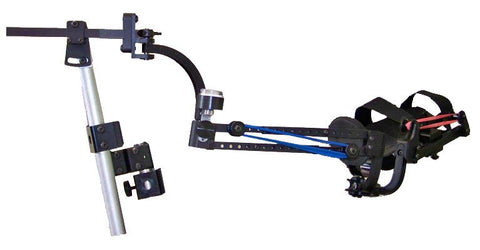

- New and used manual carriers (non-electric for behind the vehicle) for wheelchairs and scooters

- Used oxygen tank holders for wheelchairs and scooters

- Accessible Taxicabs

- Software electronically transferred or web-based is not considered to be tangible personal property and is not subject to Florida sales tax. Software is exempt if a salesperson surveys a buyer’s needs and makes recommendations.

- Equipment, labor, repairs, & energy purchased to manufacture something in FL

Provide or enhance mobility of physically disabled persons

State of Florida 6% sales tax retail sale, lease or rental of most goods.

Counties impose additional surtaxes of 0% to 1.5%. Florida’s county surtax rates are capped on purchases over $5,000, which is different from other states. For example, if you purchased a motor vehicle with the purchase price of $20,000 in a county with a 1% surtax rate, 7% tax would be due on the first $5,000 of the purchase price and 6% tax would be due on the remaining $15,000 of the purchase price.

Use tax is due on all purchases brought into the state of Florida, unless specifically exempted. Use tax is due at the same rates as sales tax. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made.

Property Taxes are Exempt for Disabled Persons or Veterans in Florida up to income limit $31,741 in 2022